Discover why optimising your O2C processes is important and learn a four-step approach to achieve success.

Maximising efficiency: Optimising order-to-cash processes

Maximising efficiency: Optimising order-to-cash processes

Discover why optimising your O2C processes is important and learn a four-step approach to achieve success.

Meet the author

Many organisations focus exclusively on in-year benefits and quick wins at the expense of discovering the deeper opportunities within order to cash (O2C). However, taking a deeper look into these processes can reveal hidden opportunities that can lead to long-lasting results and significant value. This article delves into the importance of reassessing and improving O2C processes and offers a four-step approach to achieve optimal results.

Unveiling the complexity concealed within O2C processes:

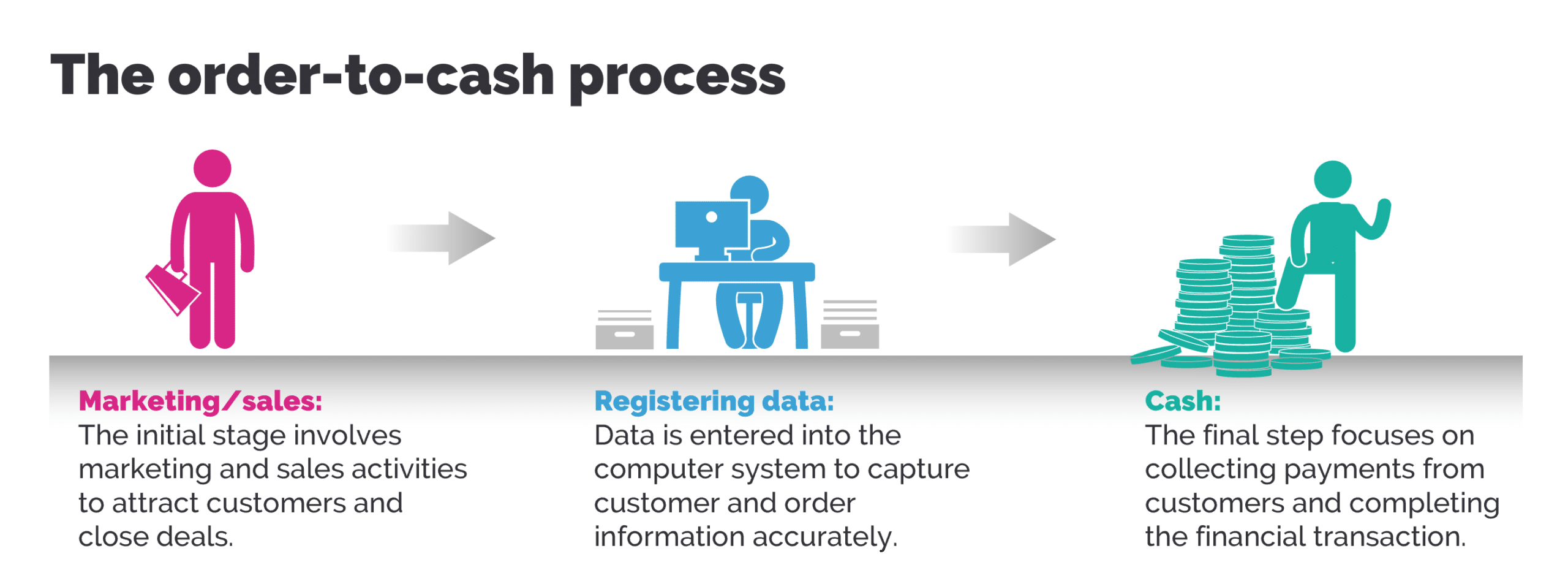

The order-to-cash process is an intricate and multifaceted general and administrative (G&A) process that impacts (and is impacted by) various functions, including commercial, sales, finance, legal, and customer support. Achieving cross-functional alignment becomes crucial for a comprehensive understanding of the challenges within the O2C process. Moreover, the impact of siloed functions extends beyond higher costs, inefficiency, and margin leakages—it significantly affects customer experience and revenue growth. In an era of rising customer expectations, businesses must adapt their O2C processes to deliver touchless order experiences, real-time updates, and quick dispute resolution.

Harnessing data insights for O2C optimisation:

Traditionally, organisations have relied on anecdotal evidence and hearsay to evaluate their O2C processes. However, with the advent of advanced digital capabilities, businesses can now extract valuable data from enterprise resource planning (ERP) systems and conduct granular analyses at the transaction level. By deploying process-mining techniques, building digital twins, and leveraging these data insights, organisations gain a more accurate understanding of their performance and identify hidden value sources and areas for improvement.

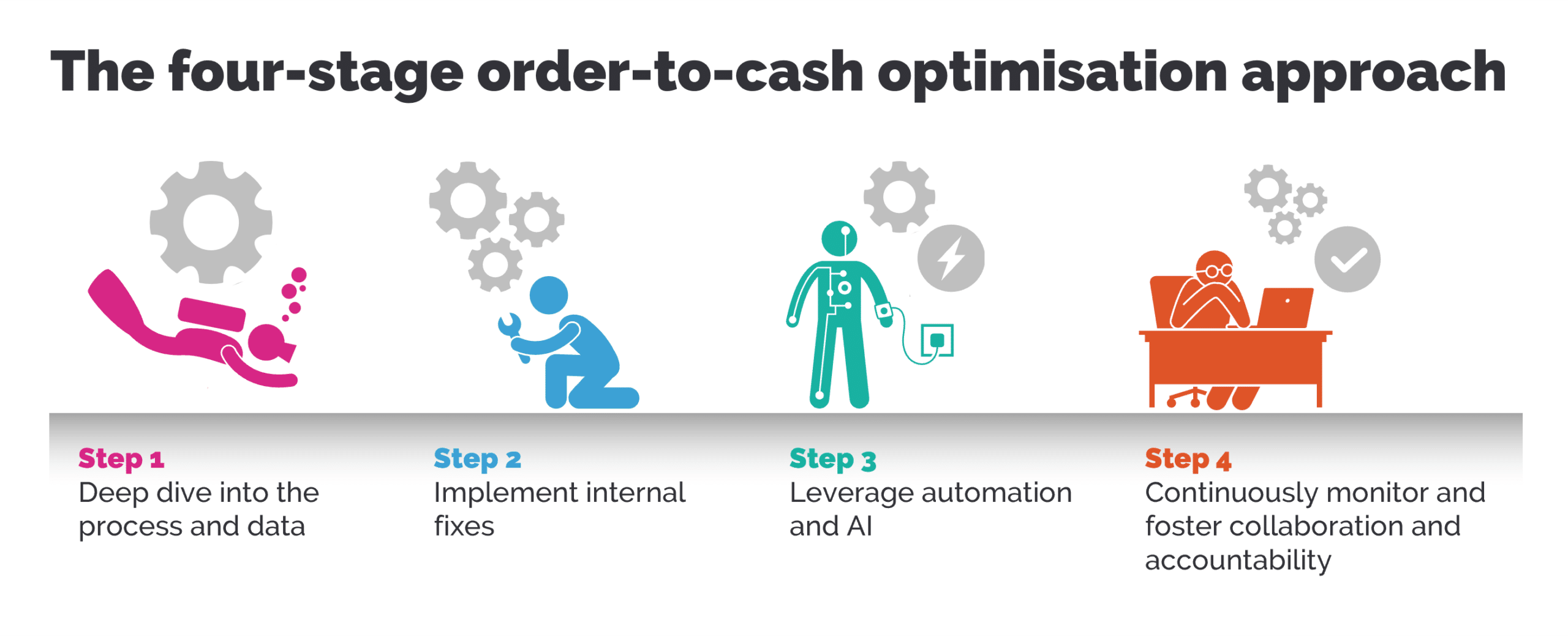

The power of O2C optimisation: A four-step approach:

To unlock the true potential of O2C processes and achieve sustainable improvements, organisations should follow a four-step approach:

Step 1: Deep dive into the process and data:

Thoroughly understanding the O2C process and analysing underlying data is paramount. By employing process-mining techniques on ERP transaction data, organisations can uncover patterns of errors, revenue leakage, and pain points that were previously challenging to identify. These insights provide a solid foundation for developing targeted initiatives to enhance process efficiency, effectiveness, and customer experience.

Step 2: Implement internal fixes:

Optimising O2C requires internal measures to address process challenges. Digitising the order process, streamlining order holds and credit-check processes, and ensuring robust validation and monitoring of payment and credit notes are key actions to consider. These changes can substantially impact efficiency and help recapture value leakage.

Step 3: Leverage automation and AI:

Embracing automation and leveraging artificial intelligence (AI) technologies can drive significant improvements in O2C processes. Automating routine tasks, such as order entry and invoice generation, not only reduces errors but also frees up resources for more strategic activities. AI-powered analytics can provide real-time insights, enabling proactive decision-making and enhancing the overall efficiency of the O2C workflow.

Step 4: Continuously monitor and foster collaboration and accountability:

O2C optimisation is an ongoing process. Organisations must establish robust monitoring mechanisms to track key performance indicators (KPIs) and measure the impact of implemented initiatives. Regular performance evaluations enable the identification of areas that require further refinement and facilitate continuous improvement in O2C processes.

Beyond technological and process-related solutions, sustainable improvements hinge on effective organisational structure and accountability. Appointing an O2C global process owner (GPO) with cross-functional authority enables the mobilisation of resources and drives efficiency across the workflow. By encouraging collaboration GPO plays a vital role in aligning outsourced O2C services with end-customer priorities and facilitates continuous improvement efforts.

Conclusion:

By embracing a comprehensive approach to O2C optimisation, organisations can unlock significant value and achieve enduring results. Through a meticulous examination of processes, data-driven insights, and the implementation of targeted initiatives, businesses can elevate customer experience, boost revenue growth, and enhance cost efficiency in the dynamic landscape of modern commerce.

If you need help with optimising your order / lead to cash processes, get in touch.