Our KYC review can help you find out

Do you know your KYC operation?

Do you know your KYC operation?

Our KYC review can help you find out

Meet the author

Whether it’s internal business pressure to minimise the time to trade, the threat of regulators conducting an audit (or worse, a section 166) or simply trying to keep on top of new KYC regulation, it’s not an easy time to have any sort of role in keeping your company compliant.

New regulations from MiFID II to the 4th Money Laundering Directive are increasingly expanding the people, processes, systems and data that you have to keep on top of when Knowing Your Customer.

In many cases, just understanding this landscape feels like an almost impossible task, let alone being able to assess whether the different components are in a healthy state.

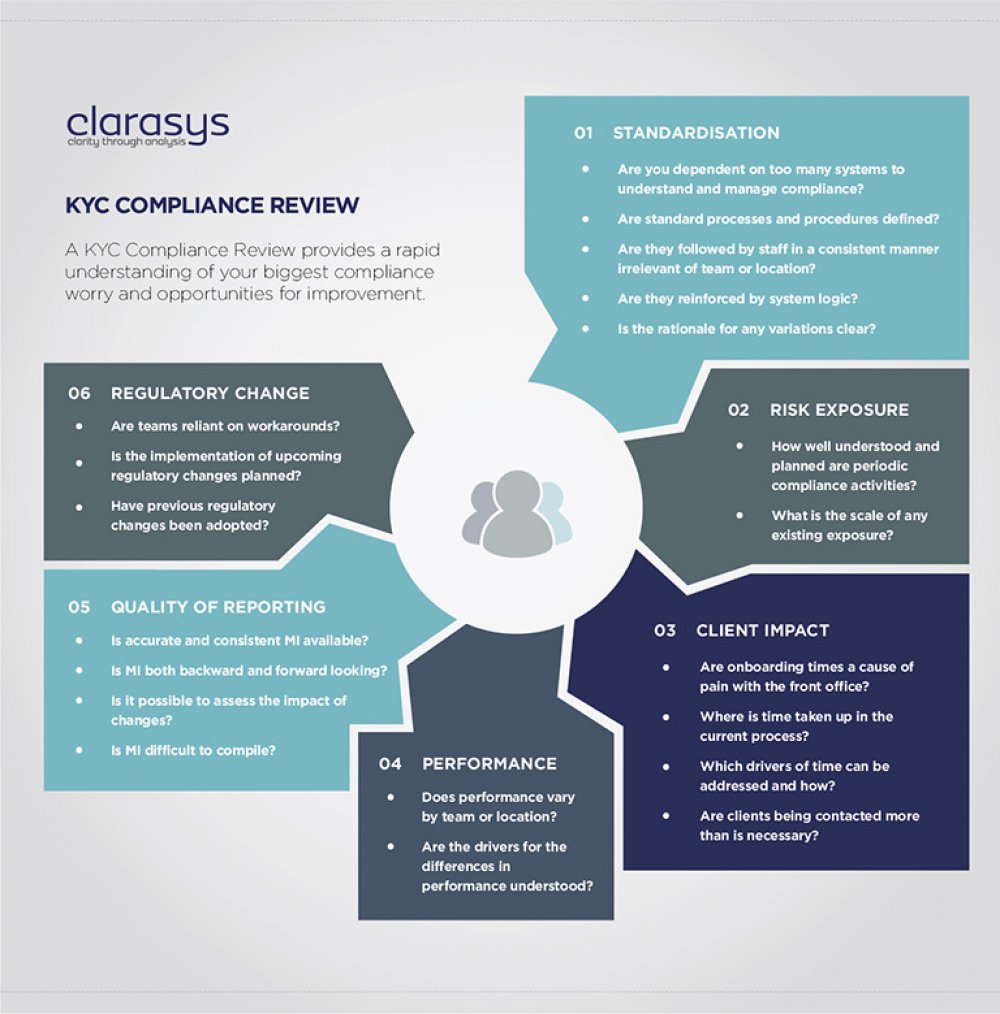

That’s why we offer a KYC review – to provide you a quick, cost effective way of understanding how your business processes are supporting your efforts to remain compliant. As an outcome, we provide a clear, coherent understanding of your current situation and the opportunities for improvement.

At the end of the process, which can be completed in as little as a week (depending on company size and requirements), your team will know the true strengths and weaknesses of how your processes support your KYC compliance and what steps can be taken to deliver the required improvements. Because we engage all stakeholders in the review and analysis process the team are also fully onboard and feel empowered to deliver change rather than resistant to what can be perceived as management interference.

The review looks at seven elements within the key areas of Cost, Performance, Risk and Client Impact.

How we do it

The first thing we do is spend time with you to understand your highest priority areas of concern, what symptoms you’re feeling and why. The KYC universe is vast, and there will always be some things that are higher on the worry list than others. These initial conversations will help us agree together the scope of the health check so you know that we are focusing on what you want covered.

Our review will then follow three basic steps:

- Analysis: Wherever we can, we take a data led approach by gathering information, documentation and metrics and analysing it all to establish hypotheses against the 7 key dimensions.

- Interviews: Hypotheses are tested through interviews and/or workshops with key staff so we can understand the ‘human side’ to the data and processes.

- Recommendations: Analysis is consolidated to produce recommendations against your processes. These will be presented at a workshop with key stakeholders where actionable steps are identified and agreed upon to deliver the required improvements.

One of the key points that makes Clarasys different from other consultancy firms is our integration with your business. We won’t just sweep into your office and sit in a corner reviewing documents, we want to get a real understanding of your business and the only way we can do this is by working alongside your teams. By being visible and approachable our consultants learn about the people in your business, how they work and what will help them implement processes better, as well as the data and systems you use.

The cost

Our KYC review has been designed to provide you with a cost effective solution for your business. Reviews start from as little as £2,500 for a single location and focus area. For larger companies, or a broader set of concerns, the review is fully scalable and can be conducted across multiple sites in different international locations.

Your cost includes interviews and workshops as well as the final analysis, recommendations and improvement plan so you can start implementing solutions immediately. If you’d like extra support our teams can arrange project management support and continued consultancy at a level that suits your needs best.

What to do next?

Following the introduction of the 4th Money Laundering Directive and the improving technologies available there is a real need for businesses to understand where they are and what they need to change before spending small fortunes on implementing new systems and processes.

For more information on how our KYC Review could help your business with compliance and customer service, call Tim or Fred on 0203 7330 246 or complete our enquiry form – we’ll call you straight back.